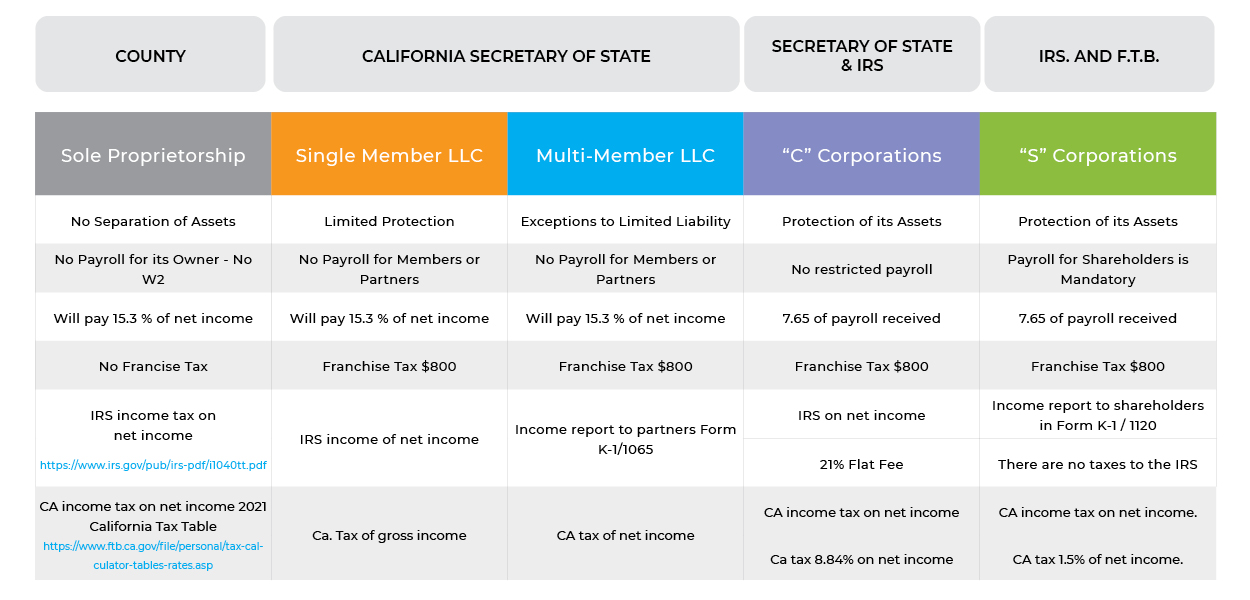

Your personal and business investment depend on you and are at permanent risk

The owner of a self-employed business cannot pay himself a salary all the profit from the business is his

The owner of a self-employed business cannot be paid a salary all the profit of the business is his to a tax of 15.3% for Self-employment tax.

There is no franchise tax, if the name registration must be renewed every 5 years in the county

You also have to pay tax to the IRS this tax is for your earnings and it is progressive for this we leave you a link with the tables

You also have to pay tax to the FTB this tax is for your earnings and it is progressive for it we leave you a link with the tables

A limited liability company (LLC) offers personal liability protection for business debts, similar but not the same as a corporation. While setting up an LLC is more difficult than setting up a partnership or sole proprietorship.

Limited Personal Liability

Like shareholders of a corporation, all LLC owners are protected from personal liability for business debts and claims. This means that if the business itself can't pay a creditor—such as a supplier, a lender, or a landlord—the creditor cannot legally come after an LLC member's house, car, or other personal possessions. Because only LLC assets are used to pay off business debts, LLC owners stand to lose only the money that they've invested in the LLC. This feature is often called "limited liability.

The owner of a self-employed business cannot pay himself a salary all the profit from the business is his

Unlike a corporation, an LLC is not considered separate from its owners for tax purposes. Instead, it is what the IRS calls a "pass-through entity," like a partnership or sole proprietorship. This means that business income passes through the business to the LLC members, who report their share of profits—or losses—on their individual income tax returns. Each LLC member must make quarterly estimated tax payments to the IRS. While an LLC itself doesn't pay taxes, co-owned LLCs must file Form 1065, an informational return, with the IRS each year. This form, which partnerships also have to file, sets out each LLC member's share of the LLC's profits (or losses), which the IRS reviews to make sure LLC members are correctly reporting their income.

Each LLC doing business or organized in California must pay an annual tax of $800. This annual tax will be due, even if you are not in business, until you cancel your LLC. You have until the 15th day of the 4th month from the date of filing with the SOS to pay your annual tax for the first year.

the tax due to the IRS equal to sole proprietorship businesses.

$250,000 to $499,999 tax = $900

$500,000 to $ 999,999 tax = 2,500

$1,000,000 to $ 4,999,999 tax = 6,000

$5,000,000 or More tax = $11,700

What does LLC mean?

LLC stands for Limited Liability Company. A limited liability company is a business entity separate from its owners, like a corporation. However, unlike a corporation, which must pay its own taxes, an LLC is a "pass-through" tax entity: the business's profits and losses pass to its owners, who report them on their personal tax returns as they would. if they owned a partnership or sole proprietorship. Some people mistakenly think that LLC means "limited liability company", but it is not a corporation. Another mistake is believing that forming and managing an LLC is less complex and requires less paperwork than a corporation.

While LLC owners enjoy limited personal liability for many of their business transactions, this protection is not absolute. This drawback is not unique to LLCs, however—the same exceptions apply to corporations. An LLC owner can be held personally liable if he or she: personally and directly injures someone personally guarantees a bank loan or a business debt on which the LLC defaults fails to deposit taxes withheld from employees' wages intentionally does something fraudulent, illegal, or reckless that causes harm to the company or to someone else, or treats the LLC as an extension of his or her personal affairs, rather than as a separate legal entity. This last exception is the most important. If owners don't treat the LLC as a separate business, a court might decide that the LLC doesn't really exist and find that its owners are really doing business as individuals who are personally liable for their acts. To keep this from happening, make sure you and your co-owners: Act fairly and legally. Do not conceal or misrepresent material facts or the state of your finances to vendors, creditors, or other outsiders. Fund your LLC adequately. Invest enough cash in the business so that your LLC can meet foreseeable expenses and liabilities. Keep LLC and personal business separate. Get a federal employer identification number, open up a business-only checking account, and keep your personal finances out of your LLC accounting books. Create an operating agreement. Having a formal written operating agreement lends credibility to your LLC's separate existence.

The owner of a self-employed business cannot pay himself a salary all the profit from the business is his

Unlike a corporation, an LLC is not considered separate from its owners for tax purposes. Instead, it is what the IRS calls a "pass-through entity," like a partnership or sole proprietorship. This means that business income passes through the business to the LLC members, who report their share of profits—or losses—on their individual income tax returns. Each LLC member must make quarterly estimated tax payments to the IRS. While an LLC itself doesn't pay taxes, co-owned LLCs must file Form 1065, an informational return, with the IRS each year. This form, which partnerships also have to file, sets out each LLC member's share of the LLC's profits (or losses), which the IRS reviews to make sure LLC members are correctly reporting their income.

Each LLC doing business or organized in California must pay an annual tax of $800. This annual tax will be due, even if you are not in business, until you cancel your LLC. You have until the 15th day of the 4th month from the date of filing with the SOS to pay your annual tax for the first year.

K-1 Forms for Business Partnerships

For businesses operating as partnerships, it is the partners who are responsible for paying taxes on the business income, not the business. Each partner is responsible for filing an individual tax return that reports their share of the income, losses, tax deductions, and tax credits that the business reported on the 1065 tax information form. As a result, the partnership must prepare a Schedule K-1 to report each partner's share of these tax items.

Note: each partner is responsible for paying their own self-employment tax 15.3% and also income tax

$250,000 to $499,999 tax = $900

$500,000 to $ 999,999 tax = 2,500

$1,000,000 to $ 4,999,999 tax = 6,000

$5,000,000 or More tax = $11,700

Advantages of a C Corporation: There are many benefits of a c corp. Below are just a few that stand out. Limited liability. This applies to directors, officers, shareholders, and employees. Perpetual existence. Even if the owner leaves the company. Enhanced credibility. Gain respect among suppliers and lenders. Unlimited growth potential. The sky's the limit thanks to the sale of stock. No shareholders limit. However, once the company has $10 million in assets and 500 shareholders, it is required to register with the SEC under the Securities Exchange Act of 1934.

Certain tax advantages. Enjoy tax-deductible business expenses

Disadvantages of a C Corporation: Having unlimited growth comes with a few minor setbacks. Double taxation. It's inevitable as revenue is taxed at the company level and again as shareholder dividends. Expensive to start. There are a lot of fees that come with filing the Articles of Incorporation. And corporations pay fees to the state in which they operate. Regulations and formalities. C corps experience more government oversight than other companies due to complex tax rules and the protection provided to owners from being responsible for debts, lawsuits, and other financial obligations. No deduction of corporate losses. Unlike an s corporation (s corp), shareholders can't deduct losses on their personal tax returns.

What Is Asset Protection?

Asset protection is the adoption of strategies to guard one's wealth. Asset protection is a component of financial planning intended to protect one's assets from creditor claims. Individuals and business entities use asset protection techniques to limit creditors' access to certain valuable assets while operating within the bounds of debtor-creditor law.

What Are Payroll Taxes and Who Pays Them?

Chances are, if you were to pull out your latest pay stub, you would see two important lines among the list of taxes taken out of your wages: FICA and MEDFICA. If you were to do the math, these two lines, standing for Federal Insurance Contributions Act and Medicare Federal Insurance Contributions Act respectively, take up 7.65 percent of your wages.

What are Payroll Taxes?

Put simply, payroll taxes are taxes paid on the wages and salaries of employees. These taxes are used to finance social insurance programs, such as Social Security and Medicare. According to recent Tax Foundation research, these social insurance taxes make up 23.05 percent of combined federal, state, and local government revenue – the second largest source of government revenue in the United States.

The largest of these social insurance taxes are the two federal payroll taxes, which show up as FICA and MEDFICA on your pay stub. The first is a 12.4 percent tax to fund Social Security, and the second is a 2.9 percent tax to fund Medicare, for a combined rate of 15.3 percent. Half of payroll taxes (7.65 percent) are remitted directly by employers, while the other half (7.65 percent) are taken out of workers’ paychecks

In California, the tax rate for corporations is:

C corporations: 8.84%

Federal corporate income tax rate

First things first: what is the federal corporate tax rate? The current corporate tax rate (federal) is 21%, thanks to the Tax Cuts and Jobs Act of 2017.

Prior to the Tax Cuts and Jobs Act, there were taxable income brackets. The maximum tax rate was 35%.

The corporate tax rate applies to your business’s taxable income, which is your revenue minus expenses (e.g., cost of goods sold).

for an income of $0 to $9,050 the tax in 2021 is $800 franchise tax

What is a pass-through entity?

S corporations are a popular method to organize a business for numerous reasons, including tax and legal liability considerations. An S corporation is a type of pass-through entity, which means business income, losses, deductions, and credits “pass through” to the owner’s personal tax return. While the S corporation has to file a tax return, the owners pay the taxes with their personal tax returns. If your business is eligible for a tax credit, for example, the credit would be included in the business tax return, along with any additional information required about the credit. Any business activity, including business expenses, should be considered when putting together your pass-through entity taxes. If you miss any allowable credits or deductions, you could wind up owing more in personal taxes. An S corp isn’t the only type of pass-through entity. For example, some LLCs can opt for S corp taxation, which gives them essentially identical tax treatment to a standalone S corporation. It’s critical for businesses to know their tax requirements and submit the right forms by the due date, or they could wind up responsible for paying fines.

What Is Asset Protection?

Asset protection is the adoption of strategies to guard one's wealth. Asset protection is a component of financial planning intended to protect one's assets from creditor claims. Individuals and business entities use asset protection techniques to limit creditors' access to certain valuable assets while operating within the bounds of debtor-creditor law.

Who Really Pays Payroll Taxes?

Perhaps one of the best-kept secrets of payroll taxes is that employees effectively pay almost the entire payroll tax, instead of splitting the burden with their employers. This is because tax incidence is not determined by law, but by markets. In fact, the person who is required to pay a tax to the federal government is often different than the person who bears the tax burden. Usually, the marketplace decides how the tax burden is divided between buyers and sellers, based on which party is more sensitive to changes in prices (economists call this “relative price elasticities”). This means that, rather than workers and employers each paying 7.65 percent in payroll taxes, employers send their portion of the tax to the government and then decrease workers’ wages by almost 7.65 percent. Next, workers pay their 7.65 percent share on those wages. In effect, there is hardly such a thing as the “employer-side” payroll tax, because almost the entire burden of the payroll tax is passed on to employees in the form of lower wages.

Schedule K-1 records each owners’ share of the business’s income, deductions, credits, and other financial items. The corporation submits a copy of all K-1s to the IRS with the 1120S form. Each owner gets their own copy used to complete their personal tax returns. The K-1 form consists of three sections: Part I - Information About the Corporation. Part II - Information About the Shareholder. Part III - Shareholder’s Share of Current Year Income, Deductions, Credits, and other Items S corporations are required by law to submit an annual tax return. As part of preparing Form 1120S for the return, your tax preparer should also create a unique Schedule K 1 for every shareholder. In California, the tax rate for corporations is:

S corporations: 1.5%, Professional corporations: 8.84% unless they elect S corp status. Whether or not a corporation is native to the state or not makes no difference insofar as the tax rates are concerned: domestic and foreign (out-of-state) businesses both pay the same tax rate. Likewise, whether or not a corporation is active, inactive, filing a short-period return (under 12 months), or operating at a loss has no effect on the tax rate. This means that even if your company does not operate and shows no profit, it must still pay the $800 minimum by virtue of existing. Thus, the only way to avoid the tax is to dissolve the company.

The $800 minimum franchise tax is the minimum franchise fee that a corporation will have to pay to operate in California, which is similar to the tax situation in many states. What is not similar, however, is the structure and rate of this tax. For California companies, the franchise tax will be either a percentage of their income or $800, whatever is larger.

A limited liability company (LLC) offers personal liability protection for business debts, similar but not the same as a corporation. While setting up an LLC is more difficult than setting up a partnership or sole proprietorship.

A limited liability company (LLC) offers personal liability protection for business debts, similar but not the same as a corporation. While setting up an LLC is more difficult than setting up a partnership or sole proprietorship.